The majority of states impose a form of a corporate income tax. However, currently five states—Delaware, Ohio, Nevada, Texas and Washington—impose a broad-based, statewide corporate gross receipts tax. The most recent addition to that list is Nevada, which in its 2015 Legislative Session enacted a new Commerce Tax that is imposed on gross revenue. More recently, there have been and are, at the time of writing, ongoing efforts in Oregon to enact a corporate gross receipts tax, either as a separate tax or as an alternative tax to the existing Oregon corporate income/excise tax. Even more recently, both West Virginia and Louisiana have considered a gross receipts tax.

(The remainder of this article can be access in the July 2017 edition of the Journal of Multistate Taxation and Incentives.)

SeeSALT Blog

SeeSALT Blog

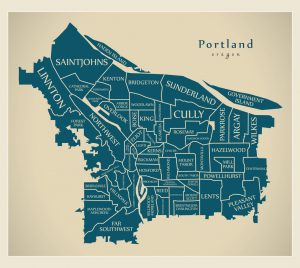

As of January 1, 2019, large retailers doing business in Portland, Ore., are subject to a

As of January 1, 2019, large retailers doing business in Portland, Ore., are subject to a