In Tesoro Logistics Northwest Pipeline LLC v. Department of Revenue (002), the Oregon Tax Court, Regular Division, held that although a unit of property acquired by one centrally assessed company from another qualified as “new property” for purposes of Or. Const. Art. XI, § 11 (Measure 50), the unit of property’s existing maximum assessed value (MAV) was preserved in the hands of the new owner. Tesoro Logistics Nw. Pipeline LLC v. Dep’t of Revenue, No. TC 5252, 2021 WL 6700471 (Or. Tax Ct., Reg. Div., Feb. 19, 2021). As a result, the Oregon Department of Revenue was not entitled to redetermine the MAV on account of the acquisition.

Articles Posted in Oregon

Oregon Tax Court Applies Wayfair Retroactively in Telecommunications Tax Case

The Regular Division of the Oregon Tax Court just handed down a nexus decision with respect to the collection of an emergency telecommunications tax (E911 Tax). In Ooma, Inc. v. Department of Revenue, TC 5331 Tax Court, 03/02/2020, the Court concluded that notwithstanding the absence of physical presence in Oregon, a company which provided VOIP services to Oregon customers, was required to collect the E911 Tax. Continue Reading ›

The Regular Division of the Oregon Tax Court just handed down a nexus decision with respect to the collection of an emergency telecommunications tax (E911 Tax). In Ooma, Inc. v. Department of Revenue, TC 5331 Tax Court, 03/02/2020, the Court concluded that notwithstanding the absence of physical presence in Oregon, a company which provided VOIP services to Oregon customers, was required to collect the E911 Tax. Continue Reading ›

Oregon Releases First Set of Draft CAT Rules

The Oregon Department of Revenue (DOR) has just released a series of eight draft administrative rules for Oregon’s new Corporate Activity Tax (CAT) that go into effect on January 1, 2020. In “The CAT is Almost Out of the Bag! Oregon Releases First Set of Draft CAT Rules,” SALT team members Carley Roberts, Robert P. Merten III and Afshin Michael Khazaeli examine the rules themselves, what this may mean for companies calculating commercial activity, and more.

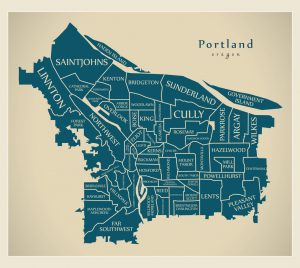

Gross! Portland, Oregon, Targets Large Retailers with New Gross Receipts Tax

As of January 1, 2019, large retailers doing business in Portland, Ore., are subject to a new 1% gross receipts tax dubbed the “Clean Energy Surcharge.” This new tax is imposed on all businesses subject to the Portland business license tax that have annual retail receipts of over $1 billion and at least $500,000 annual retail receipts attributable to Portland. This tax has complications that qualifying large retailers should keep in mind. For instance, the tax is unconventionally broad and applies to, among other things, services (generally, without enumeration), interest income from lending, and sales of houses by builders. The tax uses current-year receipts, as opposed to prior-year receipts, to determine whether the thresholds are met, so businesses that may not be sure in advance if they will meet the thresholds should take caution accordingly. Finally, as is often the case with localities, Portland intends to apply its business license tax apportionment rule (income-producing activity approach), which differs from that of the State (market-based sourcing).

As of January 1, 2019, large retailers doing business in Portland, Ore., are subject to a new 1% gross receipts tax dubbed the “Clean Energy Surcharge.” This new tax is imposed on all businesses subject to the Portland business license tax that have annual retail receipts of over $1 billion and at least $500,000 annual retail receipts attributable to Portland. This tax has complications that qualifying large retailers should keep in mind. For instance, the tax is unconventionally broad and applies to, among other things, services (generally, without enumeration), interest income from lending, and sales of houses by builders. The tax uses current-year receipts, as opposed to prior-year receipts, to determine whether the thresholds are met, so businesses that may not be sure in advance if they will meet the thresholds should take caution accordingly. Finally, as is often the case with localities, Portland intends to apply its business license tax apportionment rule (income-producing activity approach), which differs from that of the State (market-based sourcing).

Captive Audience: More States Instruct Taxpayers to Include Captive Insurance Companies in Combined Returns

(This article was originally published by Bloomberg’s Daily Tax Report: State.)

Recent developments in several key states, including Illinois, New York, Minnesota, and Oregon, will impact many captive insurance companies. These states are moving to include certain captives in corporate income tax combined returns with parents and affiliates. The effect of combination is to tax the captives’ investment income and to disallow the deductions for premiums paid to the captives. New York and Minnesota are also using the federal definitions of “insurance” to determine whether captive insurance companies are combinable and subject to corporate income tax.

SeeSALT Blog

SeeSALT Blog