As of January 1, 2019, large retailers doing business in Portland, Ore., are subject to a new 1% gross receipts tax dubbed the “Clean Energy Surcharge.” This new tax is imposed on all businesses subject to the Portland business license tax that have annual retail receipts of over $1 billion and at least $500,000 annual retail receipts attributable to Portland. This tax has complications that qualifying large retailers should keep in mind. For instance, the tax is unconventionally broad and applies to, among other things, services (generally, without enumeration), interest income from lending, and sales of houses by builders. The tax uses current-year receipts, as opposed to prior-year receipts, to determine whether the thresholds are met, so businesses that may not be sure in advance if they will meet the thresholds should take caution accordingly. Finally, as is often the case with localities, Portland intends to apply its business license tax apportionment rule (income-producing activity approach), which differs from that of the State (market-based sourcing).

As of January 1, 2019, large retailers doing business in Portland, Ore., are subject to a new 1% gross receipts tax dubbed the “Clean Energy Surcharge.” This new tax is imposed on all businesses subject to the Portland business license tax that have annual retail receipts of over $1 billion and at least $500,000 annual retail receipts attributable to Portland. This tax has complications that qualifying large retailers should keep in mind. For instance, the tax is unconventionally broad and applies to, among other things, services (generally, without enumeration), interest income from lending, and sales of houses by builders. The tax uses current-year receipts, as opposed to prior-year receipts, to determine whether the thresholds are met, so businesses that may not be sure in advance if they will meet the thresholds should take caution accordingly. Finally, as is often the case with localities, Portland intends to apply its business license tax apportionment rule (income-producing activity approach), which differs from that of the State (market-based sourcing).

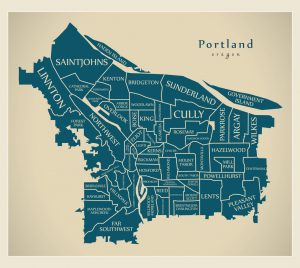

Gross! Portland, Oregon, Targets Large Retailers with New Gross Receipts Tax

Posted

SeeSALT Blog

SeeSALT Blog